Introduction

This chapter explains LINE Pay function.

LINE Pay Introduction

This document is for the developers who would like to integrate LINE Pay.

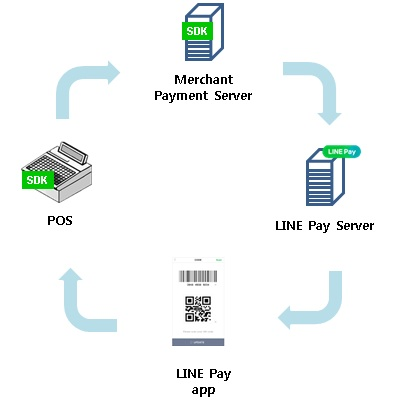

- Figure 1 LINE Pay Overview *

Integration Conditions

This chapter explains the requirements and preparation for LINE Pay Integration.

System Requirements

LINE Pay API Integration is basically a communication between LINE Pay and Merchant Server. Therefore, it needs to be integrated with the Payment Server that merchant separately prepared.

Preparation prior to Integration

Prior to LINE Pay Payment API Integration, a merchant needs to register to be a LINE Pay Merchant and check the key information needed for integration.

Merchant Registration

A Merchant needs to be registered as a LINE Pay Merchant for LINE Pay payment integration. In order to check the registration process, a merchant can download the LINE Pay Merchant Registration Guide on the merchant portal. (Location: https://pay.line.me/jp/developers/documentation/download/tech?locale=en_EN – LINE Pay Merchant Registration Guide)

Preparation for Integration

- White list registration of Merchant Payment Server

a. LINE Pay limits the server access in the channel ID uniquely generated for each merchant by IP registration of merchant's Payment Server.

b. IP registration can be done in this location - "Login to Merchant Center(http://pay.line.me) - Payment Integration Management - Manage Payment Server IP". - Channel ID and Channel Secret Key Confirmation

a. It's an essential information for API Integration and it can be found in this location - "Login to Merchant Center(http://pay.line.me) - Payment Integration Management - Manage Link Key".

b. This information must not be exposed anywhere since it is uniquely generated for each merchant. - Available currency check for payment integration

a. LINE Pay merchant can use only one currency for API Integration and available currencies are as below. It can be also found in this location - "Login to Merchant Center(http://pay.line.me) - Manage Basic Info - Merchant Information".- JPY

- USD

- THB

- TWD

Integration Flow

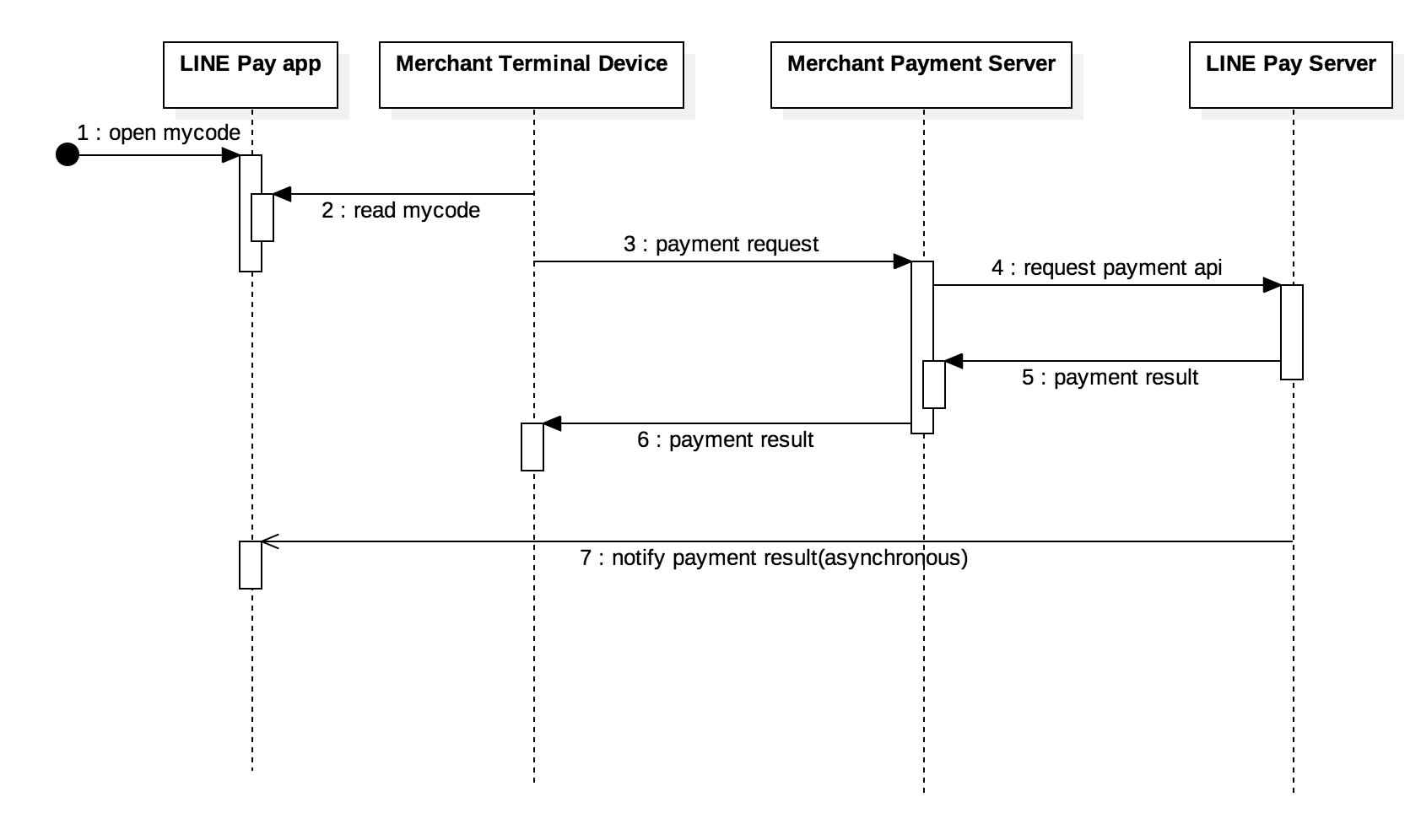

Payment Sequence diagram

It explains the process how to make a payment.

Target API

- Payment API(sequence diagram - #4)

Figure 2 Payment Sequence diagram

Payment Sequence diagram Explanation

- A LINE Pay user shows MyCode (Barcode/QR Code) to a Merchant's Device.

- Merchant's Device reads MyCode (Barcode/QR Code).

- Merchant's Device requests for payment to the merchant's Payment Server.

- Merchant Payment Server calls the Payment API.

- Check the API response information and confirm whether the payment is completed or not.

- Merchant's Payment Server responds the payment result to the Merchant's Device.

- LINE Pay Server notifies the payment result (Success/Failure) to the LINE Pay user via Push or LINE Pay Official Account Message.

After Payment Sequence

API after the payment creation process can be processed by calling API once

Target API

- VOID

- REFUND

- CAPTURE

- Authorization/Payment Details

API Specifications (Payment)

This chapter explains the APIs that are used from reading "oneTimeKey" ("MyCode" in the LINE Pay Main menu) generated from LINE Pay User to complete payment.

- Payment

- Payment Status Check

Payment

This API is to process payment by reading MyCode provided from LINE Pay App with Merchant's device.

Specification

Table 1 Payment API Endpoint

| Item | Description |

|---|---|

| Endpoint URL | Sandbox : https://sandbox-api-pay.line.me/v2/payments/oneTimeKeys/pay Product : https://api-pay.line.me/v2/payments/oneTimeKeys/pay |

| Method | POST |

| Request Header | Required - Content-Type: application/json; charset=UTF-8 - X-LINE-ChannelId: {Integration Information - channelId} - X-LINE-ChannelSecret: {Integration Information - channelSecretKey} Set whether it's necessary or not in the merchant setting information. - X-LINE-MerchantDeviceType : device type - X-LINE-MerchantDeviceProfileId : device’s serial no |

| Timeout | Read : 20 seconds |

Table 2 Payment API Request Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| productName | string(4000) | Y | product name |

| amount | number(38) | Y | amount to payment |

| currency | string(3) | Y | currency to payment |

| orderId | string(100) | Y | OrderId given by merchant device. (unique on merchant-side) |

| oneTimeKey | string(12-19) | Y | Result of scanning and reading QR/Bar code information given by LINE Pay App. oneTimeKey's valid time is 5 minutes, so it will be valid for 5 minutes from the time when LINE Pay User confirms QR/Bar code after accessing the mycode screen The length differ by country - JP : 19(from 2019.08.01) - TW : 18 - TH, Global : 12 |

| capture | boolean | N | Whether to capture or not. A boolean value (true or false) default is true. true(default) : payment authorization and capture are handled at once false : payment is completed only after it is authorized then separately capture by calling "Capture API" |

| Extra Fields | |||

| extras.addFriends | object[] | N | Add friends List

"addFriends": [{ |

| extras.branchName | string(200) | N | Branch Name where the payment is requested from (Only 100 letters will be displayed if it's exceeded.) |

| extras.branchId | String (32) | N | Branch Id where the payment is requested. It can be support alphabets, numbers and special characters. |

| extras.promotionRestriction | object | N | Promotion Restriction info.

"promotionRestriction": { |

| extras.events[] | object[] | N | Event list which is negotiated with LP. "events": [{ |

| extras.events[].code | string(4-30) | N | Unique event code which allows only alphanumeric. |

| extras.events[].totalAmount | number | N | Amount to be applied to rate promotion. |

| extras.events[].productQuantity | number | N | Amount to be applied to fixed promotion. |

Table 3 Payment API Response Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| returnCode | string(4) | Y | Result code generated by LINE Pay. - 0000 : API Request Success - Other response codes can be found at "Appendix - Response Code by API" in this document. |

| returnMessage | string(100) | Y | Result messages or reason for failure |

| info.transactionId | number(19) | Y | LINE Pay's transaction id |

| info.orderId | string(100) | Y | OrderId given by merchant device. (unique on merchant-side) |

| info.transactionDate | string(20) | Y | Transaction Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| info.payInfo[].method | string(20) | Y | Payment method used - CREDIT_CARD - BALANCE - DISCOUNT - POINT (Default is not displayed) |

| info.payInfo[].amount | number(38) | Y | payment amount |

| info.balance | number(38) | N | remained balance after payment. |

| info.authorizationExpireDate | string(20) | N | Authorization Expire Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' when the payment status is "AUTHORIZATION"(capture=false). * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| info.merchantReference.affiliateCards[].cardType | string(20) | N | Affiliated card type when belonged to the affiliated transaction and user has an affiliate card. |

| info.merchantReference.affiliateCards[].cardId | string(20) | N | Affiliated card id when belonged to the affiliated transaction and user has an affiliate card. |

Example

Request

POST https://sandbox-api-pay.line.me/v2/payments/oneTimeKeys/pay HTTP/1.1

Host: sandbox-api-pay.line.me

Content-Type: application/json

X-LINE-ChannelId: {channel id}

X-LINE-ChannelSecret: {channel secret}

X-LINE-MerchantDeviceProfileId: {DEVICE_PROFILE_ID}

{

"productName": "test product",

"amount": 100,

"currency": "THB",

"orderId": "merchant_test_order_1",

"oneTimeKey": "123456789012",

"extras" : {

"addFriends" : [

{

"type" : "LINE_AT",

"idList" : ["@aaa"]

}

],

"branchName" : "test_branch_1",

"branchId" : "branch1"

},

"events": [

{

"code": "alphanumeric",

"totalAmount": 500,

"productQuantity": null

},

{

"code": "alphanumeric2",

"totalAmount": null,

"productQuantity": 10

}

]

}

Response Body - Payment completion

{

"returnCode": "0000",

"returnMessage": "success",

"info": {

"transactionId": "2019010112345678910",

"orderId": "test_order_#1",

"transactionDate": "2019-01-01T01:01:00Z",

"payInfo": [{

"method": "BALANCE",

"amount": 10

}, {

"method": "DISCOUNT",

"amount": 5

}],

"balance": 9900

}

}

Response Body - Payment completion (When merchant affiliated cards exist)

{

"returnCode": "0000",

"returnMessage": "success",

"info": {

"transactionId": "2019010112345678910",

"orderId": "test_order_#1",

"transactionDate": "2019-01-01T01:01:00Z",

"payInfo": [

{"method": "BALANCE","amount": 10}

],

"balance": 9900,

"merchantReference" : {

"affiliateCards" : [

{"cardType": "POINT_CARD","cardId": "4822456212454"}

]

}

}

}

Payment Status Check

It's the API used when the final payment status can't be checked due to read timeout.

- The status needs to be checked by calling it at regular intervals and 3~5 seconds are recommended for the interval time.

- Payment valid time is maximum 20 minutes and it's calculated from the Payment API Response time. Therefore, a merchant should check the payment status for maximum 20 minutes. In case 20 minutes are exceeded, that transaction will be the payment that couldn't be completed due to exceeded valid time.

Specification

Table 4 Payment Status Check API Endpoint

| Item | Description |

|---|---|

| Endpoint URL | Sandbox : https://sandbox-api-pay.line.me/v2/payments/orders/{orderId}/check Product : https://api-pay.line.me/v2/payments/orders/{orderId}/check |

| Method | GET |

| Request Header | Required - Content-Type: application/json; charset=UTF-8 - X-LINE-ChannelId: {Integration Information - channelId} - X-LINE-ChannelSecret: {Integration Information - channelSecretKey} Set whether it's necessary or not in the merchant setting information. - X-LINE-MerchantDeviceType : device type - X-LINE-MerchantDeviceProfileId : device’s serial no |

| Timeout | Read : 20 seconds |

Table 5 Payment Status Check API URI Parameters

| Name | Type | Mandatory | description |

|---|---|---|---|

| orderId | string(100) | Y | - The order ID delivered when a merchant requests for payment. - It needs to be delivered after encoding to the parameter that exists in URI path. * reference : https://en.wikipedia.org/wiki/Percent-encoding |

Table 6 Payment Status Check API Response Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| returnCode | string(4) | Y | result code - 0000 : API Request Success - Other response codes can be found at "Appendix - Response Code by API" in this document. |

| returnMessage | string(100) | Y | result messages |

| info.status | string(20) | Y | payment status - COMPLETE : payment completed. - terminated status - FAIL : payment failed. - terminated status * Note : In case it's “COMPLETE” or “FAIL”, there is additionally responded information. |

| case "info.status" : "COMPLETE" | |||

| info.orderId | string(100) | Y | OrderId given by merchant device. (unique on merchant-side) |

| info.transactionDate | string(20) | Y | Transaction Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| info.payInfo[].method | string(20) | Y | Payment method used - CREDIT_CARD - BALANCE - DISCOUNT - POINT |

| info.payInfo[].amount | number(38) | Y | payment amount |

| info.balance | number(38) | N | remained balance after payment. |

| info.authorizationExpireDate | string(20) | N | Authorization Expire Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' when the payment status is "AUTHORIZATION"(capture=false). * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| case "info.status" : "FAIL" | |||

| info.failReturnCode | string(4) | Y | Fail result code - For the response codes, please check "Appendix - Response Code by API" in this document. - The response codes are the same with the Payment API's response codes. |

| info.failReturnMessage | string(100) | Y | Fail result messages |

Request

- If “orderId” is “test_order_#1”,

GET https://sandbox-api-pay.line.me/v2/payments/orders/test_order_%231/check HTTP/1.1

Host: sandbox-api-pay.line.me

Content-Type: application/json

X-LINE-ChannelId: {channel id}

X-LINE-ChannelSecret: {channel secret}

X-LINE-MerchantDeviceProfileId: {DEVICE_PROFILE_ID}

Response Body - In case the status is “COMPLETE”,

{

"returnCode": "0000",

"returnMessage": "success",

"info": {

"status": "COMPLETE",

"transactionId": "2019010112345678910",

"orderId": "test_order_#1",

"transactionDate": "2019-01-01T01:01:00Z",

"payInfo": [{

"method": "BALANCE",

"amount": 10

}, {

"method": "DISCOUNT",

"amount": 5

}],

"balance": 9900

}

}

Response Body - In case the status is “FAIL”,

{

"returnCode": "0000",

"returnMessage": "success",

"info": {

"status": "FAIL",

"failReturnCode": "1142",

"failReturnMessage" : "Insufficient balance remains."

}

}

API Specifications (After Payment)

This chapter explains the API to refund the payment or to search the payment history depending on the merchant order status after the payment is completed.

- Void

- Capture

- Refund

- Authorization Details

- Payment Details

Void

This API is to void the authorization.

Specification

Table 7 Void API Endpoint

| Item | Description |

|---|---|

| Endpoint URL | Sandbox : https://sandbox-api-pay.line.me/v2/payments/orders/{orderId}/void Product : https://api-pay.line.me/v2/payments/orders/{orderId}/void |

| Method | POST |

| Request Header | Required - Content-Type: application/json; charset=UTF-8 - X-LINE-ChannelId: {Integration Information - channelId} - X-LINE-ChannelSecret: {Integration Information - channelSecretKey} Set whether it's necessary or not in the merchant setting information. - X-LINE-MerchantDeviceType : device type - X-LINE-MerchantDeviceProfileId : device’s serial no |

| Timeout | Read : 20 seconds |

Table 8 Void API URI Parameters

| Name | Type | Mandatory | description |

|---|---|---|---|

| orderId | string(100) | Y | - The order ID delivered when a merchant requests for payment. - It needs to be delivered after encoding to the parameter that exists in URI path. * reference : https://en.wikipedia.org/wiki/Percent-encoding |

Table 9 Void API Response Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| returnCode | string(4) | Y | Result code generated by LINE Pay - 0000 : Request Success - Other response codes can be found at "Appendix - Response Code by API" in this document. |

| returnMessage | string(100) | Y | Result messages or reason for failure |

Example

Request

- If “orderId” is “test_order_#1”,

POST https://sandbox-api-pay.line.me/v2/payments/orders/test_order_%231/void HTTP/1.1

Host: sandbox-api-pay.line.me

Content-Type: application/json

X-LINE-ChannelId: {channel id}

X-LINE-ChannelSecret: {channel secret}

X-LINE-MerchantDeviceProfileId: {DEVICE_PROFILE_ID}

Response - Payment Completion

{

"returnCode": "0000",

"returnMessage": "success"

}

Capture

This API is to capture the authorized transaction.

Specification

Table 10 Capture API Endpoint

| Item | Description |

|---|---|

| Endpoint URL | Sandbox : https://sandbox-api-pay.line.me/v2/payments/orders/{orderId}/capture Product : https://api-pay.line.me/v2/payments/orders/{orderId}/capture |

| Method | POST |

| Request Header | Required - Content-Type: application/json; charset=UTF-8 - X-LINE-ChannelId: {Integration Information - channelId} - X-LINE-ChannelSecret: {Integration Information - channelSecretKey} Set whether it's necessary or not in the merchant setting information. - X-LINE-MerchantDeviceType : device type - X-LINE-MerchantDeviceProfileId : device’s serial no |

| Timeout | Read : 20 seconds |

Table 11 Capture API URI Parameters

| Name | Type | Mandatory | description |

|---|---|---|---|

| orderId | string(100) | Y | - The order ID delivered when a merchant requests for payment. - It needs to be delivered after encoding to the parameter that exists in URI path. * reference : https://en.wikipedia.org/wiki/Percent-encoding |

Table 12 Capture API Request Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| amount | number(38) | Y | amount to capture |

| currency | string(3) | Y | currency to capture |

| Extra fields | |||

| extras.promotionRestriction | object | N | Promotion Restriction info.

"promotionRestriction": { |

Table 13 Capture API Response Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| returnCode | string(4) | Y | Result code generated by LINE Pay - 0000 : API Request Success - Other response codes can be found at "Appendix - Response Code by API" in this document. |

| returnMessage | string(100) | Y | Result messages or reason for failure |

| info.transactionId | number(19) | Y | LINE Pay's transaction id |

| info.orderId | string(100) | Y | OrderId given by merchant device. (unique on merchant-side) |

| info.payInfo[].method | string(20) | Y | Payment method used - CREDIT_CARD - BALANCE - DISCOUNT - POINT (Default is not displayed) |

| info.payInfo[].amount | number(38) | Y | payment amount |

Example

Request

- If “orderId” is “test_order_#1”,

POST https://sandbox-api-pay.line.me/v2/payments/orders/test_order_%231/capture HTTP/1.1

Host: sandbox-api-pay.line.me

Content-Type: application/json

X-LINE-ChannelId: {channel id}

X-LINE-ChannelSecret: {channel secret}

X-LINE-MerchantDeviceProfileId: {DEVICE_PROFILE_ID}

{

"amount": "100"

"currency": "THB

}

Response

{

"returnCode": "0000",

"returnMessage": "success",

"info": {

"transactionId": "2019010112345678910",

"orderId": "test_order_#1",

"transactionDate": "2019-01-01T01:01:00Z",

"payInfo": [{

"method": "BALANCE",

"amount": 95

}, {

"method": "DISCOUNT",

"amount": 5

}]

}

}

Refund

This API is to refund after the payment completion (Captured data).

Specification

Table 14 Refund API Endpoint

| Item | Description |

|---|---|

| Endpoint URL | Sandbox : https://sandbox-api-pay.line.me/v2/payments/orders/{orderId}/refund Product : https://api-pay.line.me/v2/payments/orders/{orderId}/refund |

| Method | POST |

| Request Header | Required - Content-Type: application/json; charset=UTF-8 - X-LINE-ChannelId: {Integration Information - channelId} - X-LINE-ChannelSecret: {Integration Information - channelSecretKey} Set whether it's necessary or not in the merchant setting information. - X-LINE-MerchantDeviceType : device type - X-LINE-MerchantDeviceProfileId : device’s serial no |

| Timeout | Read : 20 seconds |

Table 15 Refund API URI Parameters

| Name | Type | Mandatory | description |

|---|---|---|---|

| orderId | string(100) | Y | - The order ID delivered when a merchant requests for payment. - It needs to be delivered after encoding to the parameter that exists in URI path. * reference : https://en.wikipedia.org/wiki/Percent-encoding |

Table 16 Refund API Request Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| refundAmount | number(38) | N | amount to refund. - Full refund if this parameter is not passed |

| Extra fields | |||

| extras.promotionRestriction | object | N | Promotion Restriction info.

"promotionRestriction": { |

Table 17 Refund API Response Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| returnCode | string(4) | Y | Result code generated by LINE Pay - 0000 : API Request Success - Other response codes can be found at "Appendix - Response Code by API" in this document. |

| returnMessage | string(100) | Y | Result messages or reason for failure |

| info.refundTransactionId | number(19) | Y | LINE Pay's refund transaction id |

| info.refundTransactionDate | string(20) | Y | Refunded Transaction Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' * reference : https://en.wikipedia.org/wiki/ISO_8601 |

Example

Request

- If “orderId” is “test_order_#1”,

POST https://sandbox-api-pay.line.me/v2/payments/orders/test_order_%231/refund HTTP/1.1

Host: sandbox-api-pay.line.me

Content-Type: application/json

X-LINE-ChannelId: {channel id}

X-LINE-ChannelSecret: {channel secret}

X-LINE-MerchantDeviceProfileId: {DEVICE_PROFILE_ID}

{

"refundAmount": "100"

}

Response

{

"returnCode": "0000",

"returnMessage": "success",

"info": {

"refundTransactionId": "2019010112345678910",

"refundTransactionDate": "2019-01-01T01:01:00Z"

}

}

Authorization Details

This API is to search the authorization details. Only authorized or cancelled (Void or Expire) data can be searched and the data after capturing can be searched by The Payment Details API.

Specification

Table 18 Authorizaiton Details API Endpoint

| Item | Description |

|---|---|

| Endpoint URL | Sandbox : https://sandbox-api-pay.line.me/v2/payments/authrozations Product : https://api-pay.line.me/v2/payments/authorizations |

| Method | GET |

| Request Header | Required - Content-Type: application/json; charset=UTF-8 - X-LINE-ChannelId: {Integration Information - channelId} - X-LINE-ChannelSecret: {Integration Information - channelSecretKey} Set whether it's necessary or not in the merchant setting information. - X-LINE-MerchantDeviceType : device type - X-LINE-MerchantDeviceProfileId : device’s serial no |

| Timeout | Read : 20 seconds |

Table 19 Authorization Details API Query Parameters

| Name | Type | Mandatory | description |

|---|---|---|---|

| orderId | string(100) | N | The order ID delivered when a merchant requests for payment. |

| transactionId | number(19) | N | LINE Pay’s transaction id |

Table 20 Authorization Details API Response Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| returnCode | string(4) | Y | Result code generated by LINE Pay - 0000 : Request Success - Other response codes can be found at "Appendix - Response Code by API" in this document. |

| returnMessage | string(100) | Y | Result messages or reason for failure |

| info.transactionId | number(19) | Y | LINE Pay's transaction id |

| info.orderId | string(100) | Y | OrderId given by merchant device. (unique on merchant-side) |

| info.transactionDate | string(20) | Y | Transaction Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| info.transactionType | String(20) | Y | Transaction Type - PAYMENT : payment - PAYMENT_REFUND : refund - PARTIAL_REFUND : partial refund |

| info.payInfo[].method | string(20) | Y | Payment method used - CREDIT_CARD - BALANCE - DISCOUNT - POINT (Default is not displayed) |

| info.payInfo[].amount | number(38) | Y | Payment amount |

| info.currency | string(3) | Y | Payment currency * reference : https://en.wikipedia.org/wiki/ISO_4217 |

| info.productName | string( | Y | Product name |

| info.payStatus | string(30) | Y | Payment status - AUTHORIZATION : Authorization - VOIDED_AUTHORIZATION : Voided Authorization (Completed status by calling “void api”) - EXPIRED_AUTHORIZATION : Expired Authorization (The status which allowed Authorization period for a merchant has passed.) |

| info.authorizationExpireDate | string(20) | N | Authorization Expire Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| info.merchantReference.affiliateCards[].cardType | string(20) | N | Affiliated card type when belonged to the affiliated transaction and user has an affiliate card. |

| info.merchantReference.affiliateCards[].cardId | string(20) | N | Affiliated card id when belonged to the affiliated transaction and user has an affiliate card. |

Example

Request

GET https://sandbox-api-pay.line.me/v2/payments/authorizations?orderId=20190408003 HTTP/1.1

Host: sandbox-api-pay.line.me

Content-Type: application/json

X-LINE-ChannelId: {channel id}

X-LINE-ChannelSecret: {channel secret}

X-LINE-MerchantDeviceProfileId: {DEVICE_PROFILE_ID}

Response

{

"returnCode": "0000",

"returnMessage": "success",

"info": [

{

"transactionId": 2019049910005498410,

"transactionDate": "2019-04-08T07:02:38Z",

"transactionType": "PAYMENT",

"productName": "test product",

"currency": "THB",

"authorizationExpireDate": "2019-04-13T07:02:38Z",

"payInfo": [

{

"method": "BALANCE",

"amount": 100

}

],

"orderId": "20190408003",

"payStatus": "VOIDED_AUTHORIZATION"

}

]

}

Payment Details

This API is to search the transaction data after capturing.

Specification

Table 21 Payment Details API Endpoint

| Item | Description |

|---|---|

| Endpoint URL | Sandbox : https://sandbox-api-pay.line.me/v2/payments Product : https://api-pay.line.me/v2/payments |

| Method | GET |

| Request Header | Required - Content-Type: application/json; charset=UTF-8 - X-LINE-ChannelId: {Integration Information - channelId} - X-LINE-ChannelSecret: {Integration Information - channelSecretKey} Set whether it's necessary or not in the merchant setting information. - X-LINE-MerchantDeviceType : device type - X-LINE-MerchantDeviceProfileId : device’s serial no |

| Timeout | Read : 20 seconds |

Table 22 Payment Details API Query Parameters

| Name | Type | Mandatory | description |

|---|---|---|---|

| orderId | string(100) | N | The order ID delivered when a merchant requests for payment. |

| transactionId | number(19) | N | LINE Pay’s transaction id |

Table 23 Payment Details API Response Body

| Name | Type | Mandatory | description |

|---|---|---|---|

| returnCode | string(4) | Y | Result code generated by LINE Pay - 0000 : API Request Success - Other response codes can be found at "Appendix - Response Code by API" in this document. |

| returnMessage | string(100) | Y | Result messages or reason for failure |

| info.transactionId | number(19) | Y | LINE Pay's transaction id |

| info.orderId | string(100) | Y | OrderId given by merchant device.- unique on merchant-side |

| info.transactionDate | string(20) | Y | Transaction Date(ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| info.transactionType | String(20) | Y | Transaction Type - PAYMENT : payment - PAYMENT_REFUND : refund - PARTIAL_REFUND : partial refund |

| info.payInfo[].method | string(20) | Y | Payment method used - CREDIT_CARD - BALANCE - DISCOUNT - POINT (Default is not displayed) |

| info.payInfo[].amount | number(38) | Y | Payment amount |

| info.currency | string(3) | Y | Payment currency * reference : https://en.wikipedia.org/wiki/ISO_4217 |

| info.productName | string(4000) | Y | Product name |

| Retrieving original transactions & When there is a refund | |||

| info.refundList[].refundTransactionId | number(19) | Y | Refunded transaction id |

| info.refundList[].transactionType | string(20) | Y | Transaction type - PAYMENT_REFUND : refund - PARTIAL_REFUND : partial refund |

| info.refundList[].refundAmount | number(38) | Y | Refund amount |

| info.refundList[].refundTransactionDate | String(20) | Y | Refunded transaction date (ISO8601 UTC). - Time Format : yyyy-MM-dd'T'HH:mm:ss'Z' * reference : https://en.wikipedia.org/wiki/ISO_8601 |

| When retrieving a refund | |||

| info.originalTransactionId | number(19) | Y | Original apymenttransaction number |

Example

Request

GET https://sandbox-api-pay.line.me/v2/payments/?orderId=20190408001 HTTP/1.1

Host: sandbox-api-pay.line.me

Content-Type: application/json

X-LINE-ChannelId: {channel id}

X-LINE-ChannelSecret: {channel secret}

X-LINE-MerchantDeviceProfileId: {DEVICE_PROFILE_ID}

Response

{

"returnCode": "0000",

"returnMessage": "success",

"info": [

{

"transactionId": 2019049910005496810,

"transactionDate": "2019-04-08T06:31:19Z",

"transactionType": "PAYMENT",

"productName": "test product",

"currency": "THB",

"payInfo": [

{

"method": "BALANCE",

"amount": 100

}

],

"refundList": [

{

"refundTransactionId": 2019049910005497012,

"transactionType": "PARTIAL_REFUND",

"refundAmount": -1,

"refundTransactionDate": "2019-04-08T06:33:17Z"

}

],

"orderId": "20190408001"

}

]

}

Appendix

Response Codes

This section defines error codes of LINE Pay. “returnMessage” for an error code is provided in English, and if there is no message, hyphen (-) is shown.

Table 24 LINE Pay Response

| Code(returnCode) | Description (300byte) |

|---|---|

| 0000 | Success |

| 1101 | This user is not a LINE Pay user. |

| 1102 | The purchasing user suspended for transaction. |

| 1104 | Merchant not found. |

| 1105 | This Merchant cannot use LINE Pay. |

| 1106 | Header information error |

| 1110 | Not available credit card. |

| 1124 | Error in Amount (scale). |

| 1133 | Invalid oneTimeKey |

| 1141 | Account status error. |

| 1142 | Insufficient balance remains. |

| 1145 | Payment in progress. |

| 1150 | Transaction record not found. |

| 1152 | Transaction has already been made. |

| 1153 | Request amount is different from real amount. |

| 1155 | The transaction Id not eligible for Refund. |

| 1159 | Omitted request payment information. |

| 1163 | Exceeded the expiration for Refund. |

| 1164 | Refund limit exceeded. |

| 1165 | The transaction has already been refunded |

| 1169 | Information error for payment confirm (Payment method and password must be certificated by LINE Pay.) |

| 1170 | User’s account remains have been changed. |

| 1172 | Existing same orderId. |

| 1177 | Exceeded max. number of transactions (100) allowed to be retrieved. |

| 1178 | Unsupported currency. |

| 1179 | Status can not be processed. |

| 1183 | Payment amount must be greater than 0. |

| 1184 | Payment amount exceeds amount requested. |

| 1198 | Duplicated the request calling API. |

| 1199 | Internal request error. |

| 1280 | Temporary error while making a payment with Credit Card |

| 1281 | Credit Card Payment Error |

| 1282 | Credit Card Authorization Error |

| 1283 | The payment has been declined due to suspected fraud. |

| 1284 | Credit Card Payment has been temporarily stopped. |

| 1285 | Omitted credit card information |

| 1286 | Incorrect credit card payment information |

| 1287 | Credit card expiration date has passed. |

| 1288 | Credit card has insufficient funds. |

| 1289 | Maximum credit card limit exceeded. |

| 1290 | One-time payment limit exceeded. |

| 1291 | This card has been reported stolen. |

| 1292 | This card has been suspended. |

| 1293 | Invalid Card Verification Number (CVN) |

| 1294 | This card is blacklisted. |

| 1295 | Invalid credit card number |

| 1296 | Invalid amount |

| 1298 | The credit card payment declined. |

| 1900 | Temporary Error. Please, try again later. |

| 1901 | Temporary Error. Please, try again later. |

| 1902 | Temporary Error. Please, try again later. |

| 1903 | Temporary Error. Please, try again later. |

| 1999 | It does not match the requested information. (When retrying a request) |

| 2101 | Parameter error |

| 2102 | JSON data format error |

| 2103 | Incorrect request. Please, check a returnMessage. |

| 2104 | Incorrect request. Please, check a returnMessage. |

| 9000 | Internal error |

Response Code by API

Table 25 Response Code by API

| Error Code | Payment | Payment status check | Capture | Void | Refund | Authorization Details | Payment Details |

|---|---|---|---|---|---|---|---|

| 1101 | v | v | v | ||||

| 1102 | v | v | v | ||||

| 1104 | v | v | v | v | v | v | v |

| 1105 | v | v | v | v | v | v | v |

| 1106 | v | v | v | v | v | v | v |

| 1110 | v | ||||||

| 1124 | v | v | |||||

| 1133 | v | ||||||

| 1141 | v | ||||||

| 1142 | v | ||||||

| 1145 | v | ||||||

| 1150 | v | v | v | v | v | v | |

| 1152 | v | ||||||

| 1153 | v | ||||||

| 1154 | |||||||

| 1155 | v | v | v | ||||

| 1159 | v | ||||||

| 1163 | v | ||||||

| 1164 | v | ||||||

| 1165 | v | ||||||

| 1170 | v | v | v | ||||

| 1172 | v | v | |||||

| 1177 | v | v | |||||

| 1178 | v | ||||||

| 1179 | v | v | v | ||||

| 1183 | v | v | |||||

| 1184 | v | v | |||||

| 1194 | v | ||||||

| 1198 | v | v | v | v | |||

| 1199 | v | v | v | v | |||

| 1900 | v | v | v | ||||

| 1901 | v | ||||||

| 1902 | v | ||||||

| 1903 | v | ||||||

| 1999 | v | v | v | ||||

| 2101 | v | v | v | v | v | v | v |

| 2102 | v | v | v | v | v | v | v |

| 2103 | v | v | v | v | v | v | v |

| 2104 | v | v | v | v | v | v | v |

| 9000 | v | v | v | v | v | v | v |